What is Level 3 Credit Card Processing?

How to Lower Interchange Rates Using Level 3 Data

What is Level 3 Credit Card Processing?

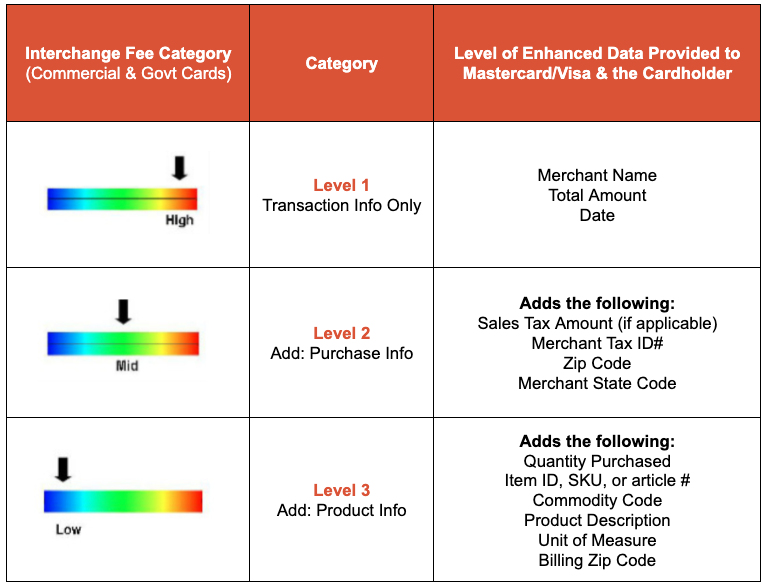

Level 3 credit card processing is used in B2B and B2G transactions to help larger businesses save on processing rates and fees. By collecting and providing an additional set of transactional data, this top level of processing offers significantly lower interchange rates for Visa and Mastercard transactions. If your business accepts corporate, purchasing, or government credit cards, you can qualify for Level 3 processing rates.

In short, the more data a business passes with a transaction, as in the case of level 3 data, the lower the interchange rate it pays to process the transaction.

Level 3 Data Explained

The card processing level your business uses is related to how much information you collect about a customer when you charge them. By default, companies process at Level 1, which means that each transaction includes:

- The card number

- Card expiration

- Billing address, and

- Zip code

To achieve Level 3 processing, you need to access and report level 3 data – a lot more data than when processing Level 1 or Level 2 transactions. Because higher data levels have lower interchange rates, it is worth learning about Level 3 processing qualification, especially if your company does a lot of B2B transactions.

For example, a transaction that qualifies at interchange for Level 1 data was processed with less information than a transaction that qualifies at Level 3 with level 3 data.

Source: ustranscorp.com

Submitting Level 3 Data

As you can see from the list above, processing Level 2 and Level 3 transactions quickly become very complex. It’s unrealistic for a business owner to supply all of this information, which is why merchants looking to benefit from interchange optimization need to work with a payment gateway that supports Level 2 and Level 3 processing.

The business owner benefits from lower processing rates, and the company or government agency making the purchase receives additional details about the transaction on their monthly statement. This comes in handy when it’s time to analyze spending.

When submitting Level 3 data with a transaction, it’s important to provide complete information in order to qualify for the best interchange rate. Although the list of required data fields looks like a lot of details to provide, some payment processors can help set it up in a way that streamlines the process.

At Payway, Level 3 processing is automated for all clients – right from the start – to reduce as many interchange fees possible for the duration of our partnership. We can autodetect if a payment is made with a procurement or corporate charge card, enabling the networks to identify which transactions qualify for the lower interchange rates.

If you still aren’t sure if your transactions would qualify for level 3 processing rates, or you want to learn additional ways your business can save money on payment processing, contact us to learn how you can start saving money on interchange fees today.