What is a Digital Wallet Payment?

What is a Digital Wallet?

A digital wallet, also known as an e-wallet or mobile wallet, is a virtual platform that securely stores payment information, such as credit card details, bank account numbers, and digital currency. It enables users to make electronic transactions, both online and offline, without the need to carry physical cash or cards. Digital wallets typically come in the form of mobile apps, accessible via smartphones, tablets, or other internet-enabled devices.

The Growth of Digital Wallet Payments

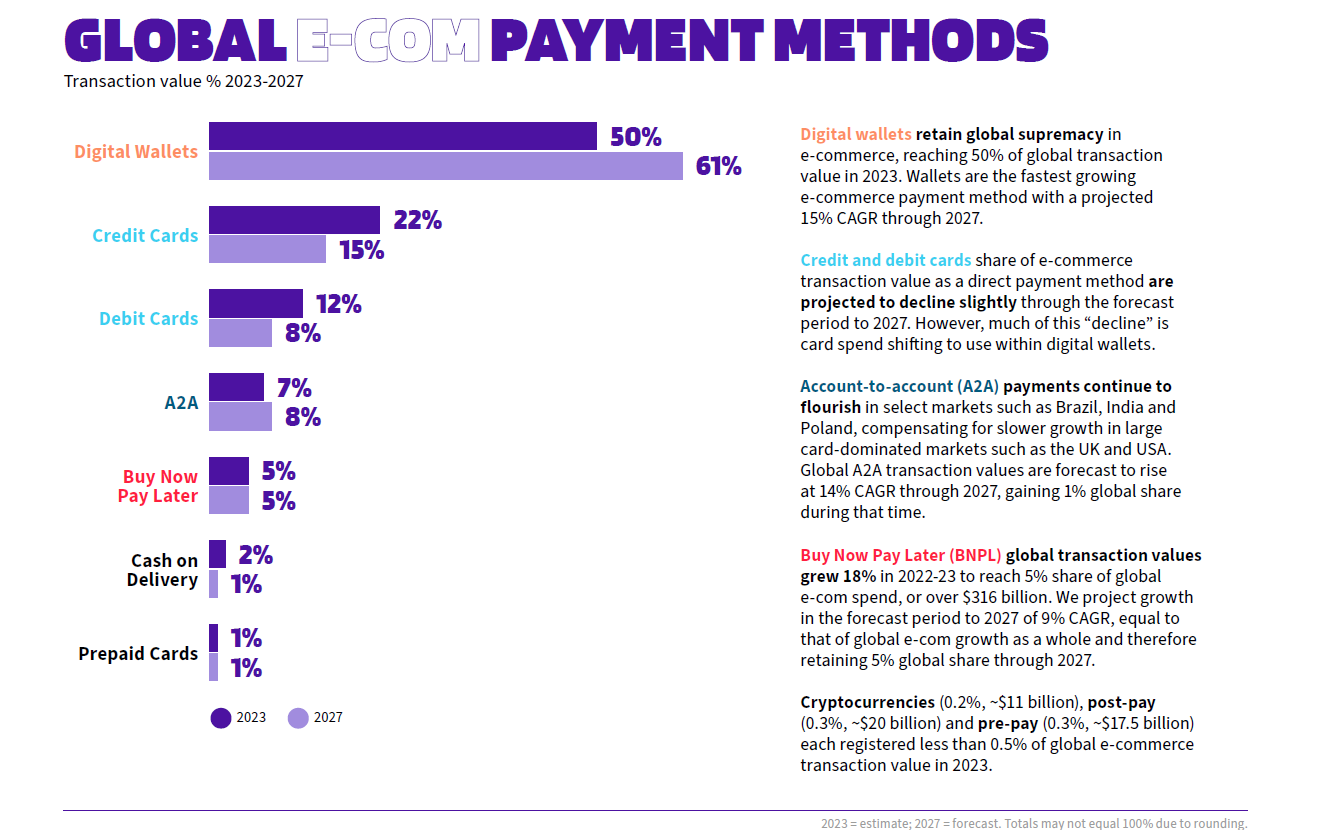

Over the past five years, digital wallets have skyrocketed in popularity due to their unparalleled convenience, enhanced security features, and the growing demand for contactless payments. According to Statista, global digital wallet transaction values reached $9.6 trillion in 2023, and this number is expected to hit $16.2 trillion by 2028. With nearly half of all e-commerce transactions now processed through digital wallets, business owners can no longer afford to ignore this payment method.

Integrating digital wallets into an online store not only caters to evolving consumer preferences but also reduces cart abandonment rates, speeds up checkout, and enhances security—leading to increased sales and customer satisfaction. With digital wallets, businesses can store payment information securely and initiate transactions with a few clicks or taps, eliminating the need for manual data entry and reducing the risk of errors. Moreover, mobile payment solutions enable businesses to accept payments on the go, empowering sales representatives and field agents to close deals efficiently.

The adoption of digital wallets has experienced exponential growth in recent years, driven by several factors:

- Convenience: Digital wallets offer unparalleled convenience because they eliminate the need to carry multiple cards or cash, allowing for swift transactions with just a tap or a scan. According to a McKinsey study, the ease of checkout and security have become table stakes for users of digital payment methods, with 74 percent of US consumers and 71 percent of European consumers surveyed indicating easier and faster checkouts as a primary reason to use digital wallets.

- Contactless Payments: The global COVID-19 pandemic accelerated the shift towards contactless payments, further fueling the adoption of digital wallets as consumers prioritize safety and hygiene.

- Mobile Commerce: The growth of smartphones and mobile commerce have contributed to the widespread acceptance of digital wallets as a preferred payment method for online shopping and in-app purchases.

- Enhanced Security Features: Digital wallets offer advanced security measures, such as tokenization and biometric authentication, which have bolstered consumer confidence in using these platforms.

According to Worldpay, Digital wallets remained the people’s payment choice for payments in 2023, accounting across channels for a combined $14 trillion in consumer spending.

(Source: Worldpay Global Payments Report 2024)

Types of Digital Wallets

There are several types of digital wallets, each catering to different user preferences and needs:

- Closed Wallets: These are digital wallets issued by specific merchants or service providers, primarily used for transactions within their ecosystem. Examples include Starbucks’ mobile app and airline loyalty program wallets.

- Semi-Closed Wallets: These digital wallets allow users to make purchases at select merchants or service providers within a predefined network. Examples include PayPal and Google Pay.

- Open Wallets: Open wallets, also known as universal wallets, support transactions across multiple merchants and platforms. They offer greater flexibility and interoperability, making them ideal for everyday use. Examples include Apple Pay and Samsung Pay.

Are Digital Wallet Payments Secure?

Security is a paramount concern for both consumers and businesses when it comes to digital transactions. Digital wallets employ several security measures to protect users’ financial information:

- Tokenization: This process replaces sensitive payment information with a unique identifier or “token,” ensuring that actual card details are not transmitted during transactions.

- Encryption: Data transmitted during transactions is encrypted, making it unreadable to unauthorized parties.

- Biometric Authentication: Many digital wallets require fingerprint scans or facial recognition to authorize payments, adding an extra layer of security.

- Two-Factor Authentication (2FA): Users may be required to verify their identity through a second method, such as a text message code, in addition to their password.

These security features have been instrumental in building trust among users, contributing to the widespread adoption of digital wallet payments.

Why Businesses Should Offer Digital Wallets

For businesses, integrating digital wallets as a payment option offers numerous benefits:

- Expanded Customer Base: By catering to the preferences of digital-savvy consumers, businesses can attract new customers and tap into previously inaccessible markets.

- Convenience:

- Reduced Cart Abandonment: Offering digital wallets as a checkout option can help reduce cart abandonment rates, as users enjoy the simplicity and convenience of completing transactions with just a few clicks. Research by Worldpay found that 59% of consumers have abandoned an online purchase because their preferred payment method wasn’t available.

- Competitive Advantage: In a competitive marketplace, businesses that embrace digital wallets gain a competitive edge by providing a modern, user-friendly payment experience that sets them apart from competitors.

- Increased security: Advanced security features protect both the business and customers from fraudulent activities.

- Data Insights: Digital wallets capture valuable transaction data and consumer insights, enabling businesses to better understand customer behavior, preferences, and purchasing patterns, which can inform marketing strategies and drive business growth.

How to Implement Digital Wallet Payments on Your Website

Integrating digital wallet payments into your website can enhance the customer experience and potentially increase conversion rates. Here are steps to guide you through the implementation process:

- Choose a Payment Gateway: Select a payment gateway that supports digital wallet transactions. Ensure that the gateway is compatible with your website’s platform and meets your business requirements.

- Set Up a Merchant Account: Register for a merchant account with your chosen payment gateway. This account will facilitate the processing of digital wallet payments.

- Integrate the Payment Gateway: Utilize the Software Development Kit (SDK) or Application Programming Interface (API) provided by the payment gateway to integrate digital wallet payment options into your website. This integration allows for seamless communication between your website and the payment processor.

- Implement Payment Buttons or Widgets: Display the supported digital wallet options (e.g., Apple Pay, Google Pay) prominently on your checkout page. Many payment gateways offer pre-built buttons or widgets to facilitate this.

- Test the Payment Process: Conduct thorough testing to ensure that the digital wallet payment process functions correctly. Verify that transactions are processed smoothly and that customers receive appropriate confirmations.

- Monitor and Optimize: After implementation, continuously monitor transactions and gather customer feedback to identify areas for improvement. Stay updated with the latest developments in digital wallet technology to keep your payment system current.

Challenges to Consider

While digital wallet payments offer numerous benefits, businesses should be aware of potential challenges:

- Technical Integration: Integrating digital wallet payments may require technical expertise and resources.

- Transaction Fees: Some digital wallet providers charge transaction fees, which can impact profit margins.

- Security Compliance: Maintaining compliance with security standards, such as PCI-DSS, is essential to protect customer data.

Future Outlook of Digital Wallet Payments

The future of digital wallet payments appears promising, with continuous advancements in technology and increasing consumer adoption. With their convenience, security, and versatility, digital wallets offer a seamless payment experience for consumers and significant benefits for businesses. By embracing digital wallets and prioritizing them as a payment option, businesses can enhance customer satisfaction, drive sales, and position themselves for success in the digital economy.