Blog

Some education, some stories, and everything else on our minds.

A Merchant’s Guide to Payment Optimization

Whether you operate a brick-and-mortar and/or online shop, ensuring your payment system is optimized can considerably impact your bottom line. The payment metho...

How to Accept Payments Online from Your WooCommerce Website

With the amount of resources available today, it is more accessible than ever to launch an online business. With lower startup costs and opportunity for global ...

Payment Predictions: Preparing for 2025 Payment Trends

From stronger security standards to quickly changing customer behaviors and emerging technologies, businesses continue grappling with a changing payment landsca...

Accepting Credit Card Payments Online

Accepting Credit Card Payments Online: Integrate Secure Payments on Your Website Today's businesses must offer their customers fast, secure, and seamless onlin...

How Credit Card Transaction Processing Works: A Complete Gui...

Understanding how credit card transaction processing works is vital for any business that accepts payments. Whether you’re accepting e-commerce payments, mana...

Understanding Subscription Models and Chargebacks

In the subscription-based business model, chargebacks are an inevitable challenge. Chargebacks occur when customers dispute a charge on their credit card, resul...

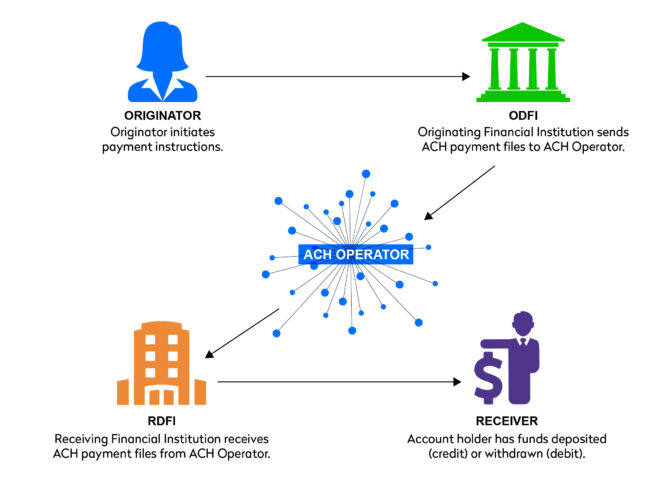

Accepting ACH Payments

Businesses and consumers alike are constantly seeking faster, more efficient, and cost-effective methods of transferring money. Among the various payment option...

Cash Discount vs. Surcharge: What’s the Difference and How...

As consumers become more aware of fees and extra charges, businesses are racing to increase transparency in their prices and transactions. With the increasing p...

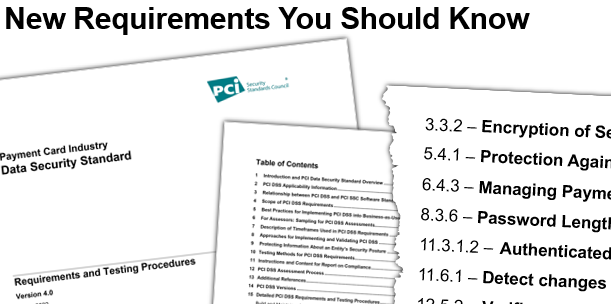

How You Can Prepare for PCI DSS Version 4

If you are conducting financial transactions with customers, your business now involves the responsibility of protecting data. Why? Because the completion of a ...

Payment Strategies to Reduce Fraud and Chargebacks

Ensuring secure transactions is paramount for businesses to maintain customer trust and mitigate risks associated with fraud and chargebacks. This article is a ...

Understanding and Mitigating Friendly Fraud in Payment Proce...

In recent years, there has been a concerning rise in incidents of friendly fraud in the payment processing industry. Despite expectations of a decline in charge...

Chargeback Defense: Protecting Your Subscription Business

Chargebacks are an unfortunate burden for many subscription-based businesses. As convenient as recurring payments are, they open the door to more disputes and f...

Payment Predictions: Preparing for 2024 Payment Trends

Chargebacks, compliance and contactless payments — oh, my! With so much change in technology and customer preferences regarding payments in recent years, 2024...

Payway Year in Review

We thank all of our customers for making our 39th year truly exceptional! Our commitment to improving services for our customers, partners, and the community re...

The Power of Headless eCommerce: A Non-Technical Guide

There's a buzzword making waves: "headless eCommerce." If you're not quite sure what this means and how it's different from regular eCommerce, we've got you cov...

Exploring Beyond Stripe: Why it Might be Time to Say Goodbye...

When it comes to payment processing solutions, Stripe has often been the go-to choice for start-ups, SMBs, Independent software vendors, and software developers...

Understanding Cost-Plus Pricing vs. Bundled Pricing

As a business owner, managing your finances efficiently is paramount to your success. One of the key financial decisions you'll face is choosing an issuing bank...

Understanding Secure Payment Processing

Protecting your customers’ data and your own is paramount in today’s threat-ridden landscape. With data breaches on the rise, you’re probably wondering ho...

Accept Apple Pay for Business

By choosing to accept Apple Pay, businesses can offer frictionless recurring payments and boost profits. Now, more than ever, digital wallets are an asset for c...

Payment Gateways and Merchant Accounts: Why You Need Both fo...

Online businesses thrive on the ability to accept payments swiftly and securely. Two crucial components in this process are payment gateways and merchant accoun...

Understanding Online Payment Gateway Integrations

You know your business needs a payment gateway and a website to thrive, but how do you make them work together? You'll need to integrate your payment gateway...

Choosing the Best Payment Gateway for Your Subscription-Base...

Selecting the best payment gateway for your subscription-based business is crucial to ensuring smooth transactions, reliable recurring revenue, and a seamless c...

Best Payment Gateway Features for Subscriptions

According to CFO Research, subscription revenue business models are on the rise and Global Banking and Finance Review reports 70% of business leaders say subscr...

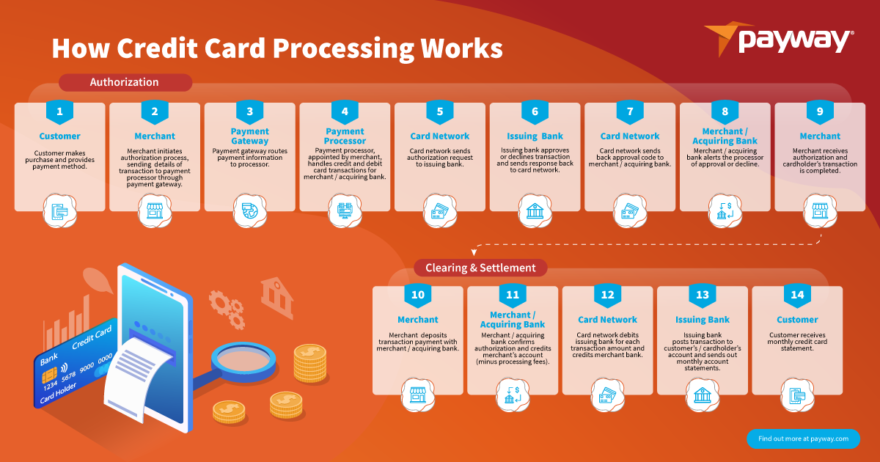

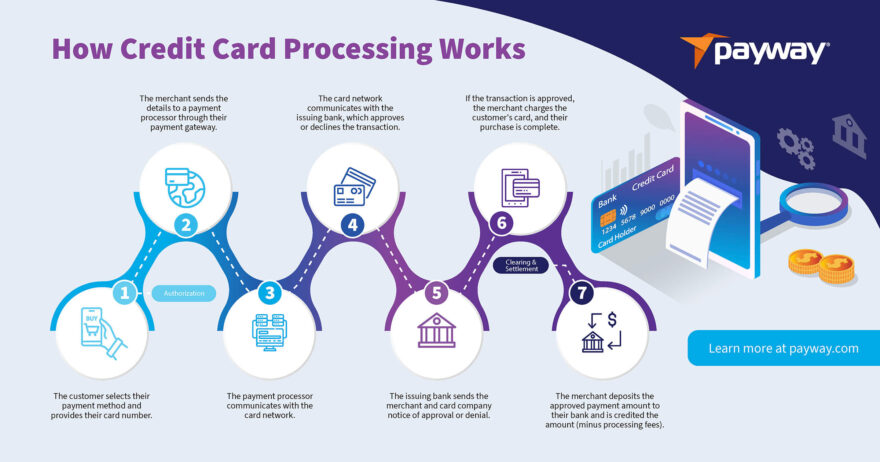

How Credit Card Processing Works “Infographic”

Credit card processing allows you to accept different types of payment. As a business owner or manager, it’s beneficial to understand how credit card processi...

What is Interchange Pass-Through Pricing?

Interchange pass-through pricing may be one way your business can realize savings in payment fees of up to 20%. There are several payment models an...

As New Digital Channels Present Opportunities. Do They Outwe...

Payment disputes—more commonly known as chargebacks—have traditionally been a major concern for merchants in the eCommerce space. Most brick-and-mortar sell...

Key Takeaways from SubSummit 2022

This year’s SubSummit did not disappoint. With insightful keynote sessions, workshops and track sessions, it provided the latest strategies from subscription ...

Interchange Fees Explained and Ways to Lower Them

What is an interchange fee? An interchange fee is a payment processing fee the card network determines and the issuing bank collects. This fee is non-negotiabl...

Interchange Rates Set to Change in April

Visa and Mastercard have announced upcoming changes to their interchanges rates. The revised fees are the first substantial revisions to the interchange schedul...

Three Technologies to Look for in a Secure Payment Gateway

Ensuring the security of payment transactions is a must for businesses and consumers alike. A secure payment gateway serves as the cornerstone of this trust, fa...

PCI-DSS Compliance

What is PCI-DSS? If you are a merchant who accepts credit and debit card payments, you are responsible for securely storing, processing, and transmitting car...

“That’s Not Our Problem. You Need to Call Your Merchant ...

Payway always does right by our customers, which is why many have trusted as their payment solution provider for over 20 years. The following are excerpts from ...

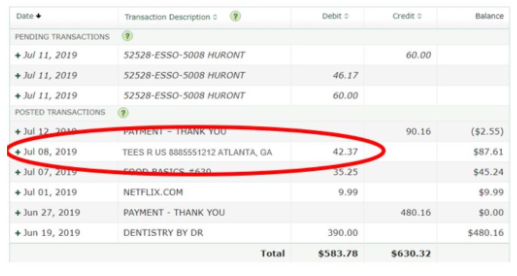

How Billing Descriptors Can Help Reduce Disputes & Char...

A billing descriptor is an explanation of a transaction and appears on a customer’s credit card statement. Poorly-thought-out billing descriptors are among th...

Top 5 Subscription Show 2021 Takeaways

Whether you attended Subscription Show 2021 in person or online, there were several messages that resonated throughout. Here are our top 5 key takeaways: 1) ...

Recurring Payment Processing: Increase Transaction Approvals

In this blog, we highlight 3 ways subscription merchants can grow their revenue by increasing transaction approvals and proper set up with their payment process...

What is Level 3 Credit Card Processing?

What is Level 3 Credit Card Processing? Level 3 credit card processing is used in B2B and B2G transactions to help larger businesses save on processing rates...

How to Accept Credit Card Payments Over the Phone

Setting up a credit card reader at the point of sale is just one cost of doing business. But what happens if you want to be able to accept credit card payments ...

Star Tribune Saves 60% with Level 3 Credit Card Processing

SUMMARY The Star Tribune of Minneapolis (Star Tribune)was challenged to reduce operating expenses without impacting its existing infrastructure. To see wha...

Understanding Cash Discount Programs

Do you think the term “cash” is only relevant for brick-and-mortar operations? Think again! Even if your business only accepts payments or subscription mana...

Optimize Your Payment Strategy to Prevent Churn

Subscription Growth Taking a cue from the Software-as-a-Service industry, companies have realized the financial benefits of recurring revenue. This has resulte...

A Checklist for Choosing the Best Payment Gateway for Recurr...

Work with a payment gateway provider that is flexible enough build the solution that will work best for your business We've put this checklist together to help...

3D Secure 2.0: What is it and How Does it Work?

What is 3D Secure? 3D Secure (3DS) is a globally accepted authentication solution designed to make eCommerce transactions more secure in real-time by providi...

Credit Card Processing & Payment Gateway Fees Explained

Pricing models matter. Credit card processing fees and payment gateway fees can be complicated and overwhelming to understand. Nevertheless, they must be pai...

Trace All Merchant Chargebacks to 3 Basic Sources

Even if you haven’t had serious issues with them first-hand, you’re probably aware of chargebacks to at least some degree. In case you’re unfamiliar, t...

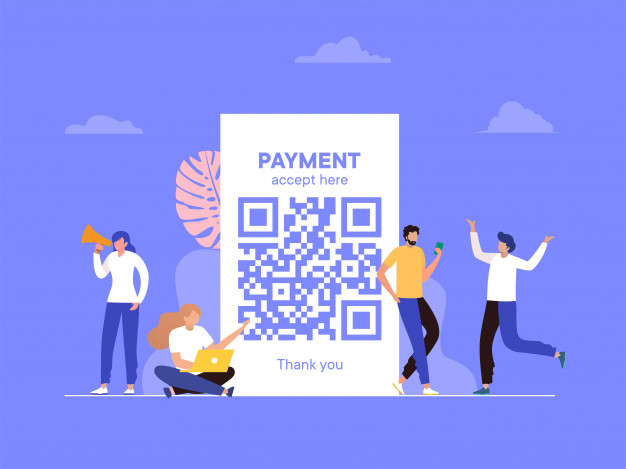

Scan to Pay Offers a Quick & Safe Payment Option

When it comes to payment options, consumers have increasingly turned towards those that allow for quick and secure transactions. As a result, digital wallets an...

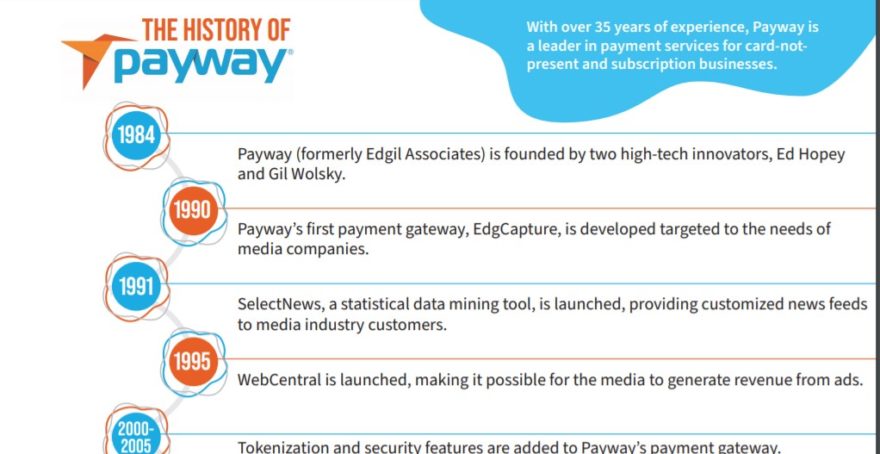

Payway History – Infographic

Payway has decades of experience in recurring payment processing and provides their customers the most up-to-date security features. Payway built their user-fri...

Merchant Accounts: What You Need to Know

If you're a business owner, you've probably heard the term "merchant account." But what exactly is a merchant account, why do you need one, what documentation i...

Recurring ACH Payments

Boost Your Business with Recurring ACH Payments ACH payments are growing in popularity. In fact, consumers processed over 30 billion ACH payments in the United...

Subscription Show 2020: 3 Key Takeaways

I hope you enjoyed Subscription Show 2020 as much as we did. There was certainly a lot of great information shared over the course of six days between the keyno...

Virtual Terminal vs. Payment Gateway

Selecting the right payment processing solution can be confusing. One of the most common misconceptions is understanding what the difference is between a paymen...

What is a Digital Wallet Payment?

What is a Digital Wallet? A digital wallet, also known as an e-wallet or mobile wallet, is a virtual platform that securely stores payment information, such as...

Three Key Market Drivers in the Payments Industry

During the past few years, payment gateways have stepped out from behind the scenes to play a leading role in how companies provide customers with improved me...

Securing Recurring Payments: What is P2PE?

For businesses that rely on recurring payments, security is essential. After all, your customers leave their sensitive payment information with you to charge re...

How Tokenization Benefits Subscription-Based Businesses

Boost subscription revenue with tokenization One of the simplest ways that subscription-based businesses can improve the shopping experience is by enabling a...

Payment Processing: The Primary Players

As part of our series, "Understanding the Ins and Outs of Credit Card Processing" we explain who the primary players are in the payment process. Most busines...

What is a Payment Gateway?

The global payment gateway market was valued at approximately USD 26.79 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 22.2...

COVID-19 and Your Business Credit Limit

Any part of running a business includes having a merchant account. You have to be able to make and take payments, and in turn, use those funds to pay your emplo...

We Give Thanks: Milestones, Mullets and More

It’s the time of year when people gather and give thanks. We’d be remiss if we didn’t partake in this tradition, especially since this year we’re a smid...

Advanced Tech is a Must for New Generation of Workers

How many times have we asked our kids to help us with an app, or post an Instagram story, or even configure our new PC? They, and their generation, don’t reme...

Did Back to School Retailers Get Fee’d?

Back-to-school shopping has become big business for retailers. According to a new study by Deloitte, total back-to-school spending was expected to hit $27.8 bil...

Top Four Things to Look for in a Payment Gateway Company

During the past few years, payment gateways have taken off, making online payments for products and services the favored payment method for consumers when makin...

2019: The year of consolidation continues

We're more than halfway through the year, and we believe it's fair to state 2019 will be known as the year of consolidation in the payments industry. Just ta...

What to Know About Contactless Payments

Anytime a small business considers adopting a new technology, they should consider the needs of their customer. Given the rise in digital wallet usage, stores o...

Five Reasons to Consider Changing Your Payments Provider

Why consider switching merchant/payment gateway partners? What are the benefits? There are several. To make it easy, we've highlighted the top five reasons: ...

Charitable Organizations Save with Payway

This time of year, more and more people find it in their hearts and wallets to donate to various charities. Last year was the sixth annual #GivingTuesday eve...

Going Digital: Why Kenosha News Moved to the Cloud with Payw...

Imagine managing a newspaper with a history of innovation and still having to rely on paper-based and manual processes for certain business operations. That ...

Protect Cardholder Data with P2PE

Almost 76 million credit card numbers were stolen from 2017-2018, according to Gemini Advisory. So how can you keep your company and your customer’s data safe...

Payway 2019 Predictions: Card-Not-Present is the Future of P...

"Venmo me" or "Zelle it" has become the way we speak to one another about transferring money. When did this become our new normal? When did our favorite cafes a...

Five things to look for in a gateway partner

What to consider when selecting a payment gateway best for your business.

Download eBook