Accepting ACH Payments

What is an ACH Payment, How They Work, and Their Benefits for Businesses and Customers

Businesses and consumers alike are constantly seeking faster, more efficient, and cost-effective methods of transferring money. Among the various payment options available, accepting ACH payments stand out as a reliable and widely used solution. Whether you’re a business owner looking to streamline your payment processes or a customer wanting to understand how your payments are handled, it’s crucial to understand what ACH payments are, how they are processed, and the benefits they offer.

What is an ACH Payment?

An Automated Clearing House (ACH) payment is a type of electronic bank-to-bank payment in the United States. It is facilitated through the ACH network, a batch processing system that financial institutions use to move money electronically between accounts. ACH payments are often used for direct deposits, bill payments, and other types of financial transactions that require a secure and efficient transfer of funds.

There are two main types of ACH transactions:

- ACH Credit: This occurs when money is “pushed” from one account to another. For example, when an employer pays an employee via direct deposit, they are initiating an ACH credit transaction.

- ACH Debit: This occurs when money is “pulled” from one account to another. An example would be when a customer authorizes a business to withdraw money from their account to pay a bill.

How Are ACH Payments Processed?

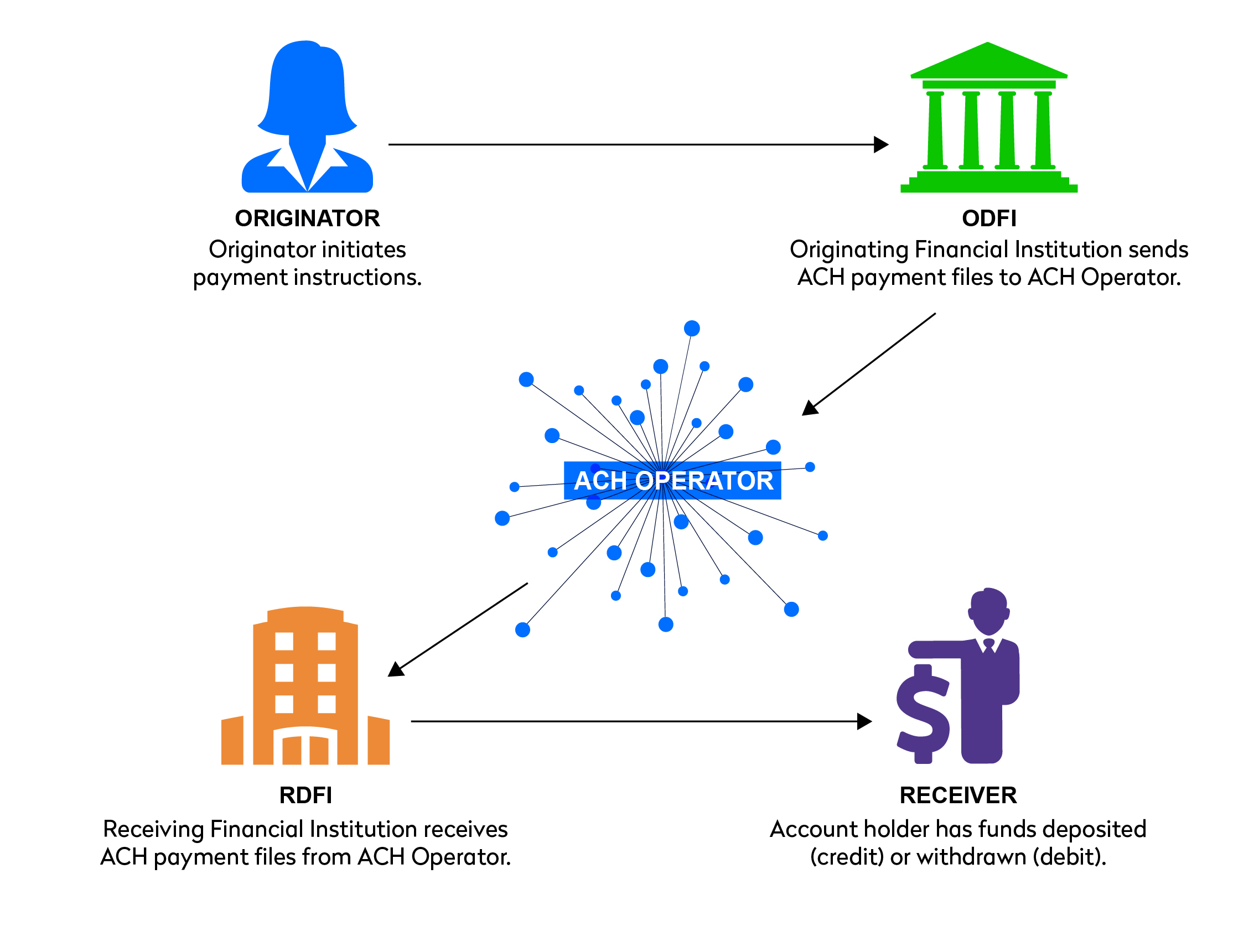

ACH payments follow a well-defined process that ensures the secure and efficient transfer of funds between accounts. Here’s a step-by-step overview of how an ACH payment is processed:

1. Authorization:

The process begins when the originator (which can be an individual, company, or government entity) obtains authorization from the receiver (the individual or business receiving the funds) to initiate an ACH transaction. This authorization can be given in various forms, including a signed agreement, an online consent, or a phone recording.

2. Initiation:

Once authorization is obtained, the originator initiates the ACH payment by submitting a payment request to their bank, known as the Originating Depository Financial Institution (ODFI). The payment request includes details such as the amount, the account numbers, and routing numbers of the involved parties.

3. Batching:

The ODFI collects multiple ACH payment requests throughout the day and submits them in batches to an ACH Operator (either the Federal Reserve or a private operator). Batching allows for the efficient processing of large volumes of transactions.

4. Clearing and Settlement:

The ACH Operator processes the batches, sorting and routing them to the appropriate Receiving Depository Financial Institutions (RDFIs) based on the account and routing numbers. The clearing process involves verifying that sufficient funds are available and that the transaction details are accurate.

Once cleared, the ACH Operator settles the transactions by transferring the net amount of funds between the ODFI and RDFI. Settlement typically occurs within one to two business days, although same-day ACH processing is also available for an additional fee.

5. Posting:

Upon receiving the ACH payment, the RDFI posts the transaction to the receiver’s account. For ACH credits, this results in the funds being credited to the receiver’s account. For ACH debits, the funds are withdrawn from the receiver’s account.

6. Finalization:

The process is finalized once the transaction is posted to the receiver’s account. The receiver is then notified of the payment, either through an account statement, email notification, or other means.

(Source: https://www.nacha.org/content/how-ach-payments-work)

Benefits of Accepting ACH Payments for Businesses

ACH payments offer numerous benefits to businesses, making them an attractive option for companies looking to optimize their payment processes. Here are some key advantages:

1. Cost-Effective:

ACH payments are generally more affordable than credit card transactions or paper checks. With lower processing fees, businesses can save money on transaction costs, which can add up significantly over time. Unlike credit card processing fees, which typically range from 1% to 4%, ACH transfers bypass the card networks entirely. Instead, these transactions are routed through the National Automated Clearing House Association (NACHA) network, which facilitates the secure transfer of funds from your customers’ accounts directly into your merchant account.

2. Improved Cash Flow:

ACH payments enable faster access to funds compared to traditional paper checks. This improved cash flow can be crucial for businesses that need to manage their finances efficiently, particularly in industries with tight margins.

3. Enhanced Security:

ACH payments are processed through a secure network, reducing the risk of fraud or unauthorized transactions. Additionally, businesses can set up verification processes to ensure that funds are available before the transaction is completed, further enhancing security.

4. Convenience:

With ACH payments, businesses can automate recurring payments, such as subscription fees or utility bills. This automation reduces administrative overhead and minimizes the risk of late payments or missed deadlines.

5. Broader Customer Reach:

By offering ACH payment options, businesses can attract customers who prefer to pay directly from their bank accounts rather than using credit cards. This can be particularly appealing to customers who are wary of credit card debt or who don’t have access to credit cards.

6. Reduced Payment Disputes:

ACH payments are less likely to be disputed compared to credit card transactions, as they require prior authorization from the customer. This can lead to fewer chargebacks and disputes, saving businesses time and resources.

Benefits of ACH Payments for Customers

Customers also stand to benefit from using ACH payments. Here are some reasons why ACH payments are advantageous for consumers:

1. Lower Costs:

Customers may avoid credit card processing fees or interest charges by paying through ACH. This can be particularly beneficial for large transactions, where credit card fees would be significant.

2. Convenience:

ACH payments allow customers to make payments directly from their bank accounts, eliminating the need to write checks, visit a payment location, or use a credit card. This convenience is especially valuable for recurring payments, such as mortgage or utility bills.

3. Security:

ACH payments are processed through a secure network with multiple layers of encryption and authentication. This ensures that sensitive financial information is protected, giving customers peace of mind when making payments.

4. Control:

With ACH payments, customers have greater control over their finances. They can schedule payments in advance, set up automatic payments, and monitor their accounts more easily than with paper checks.

5. Reliability:

ACH payments are reliable and predictable. Customers can count on their payments being processed on time, avoiding late fees or service interruptions. This reliability is particularly important for essential services, such as rent or utility payments.

Conclusion

ACH payments are a versatile, secure, and cost-effective method of transferring funds between bank accounts. By understanding how ACH payments work and the benefits they offer, both businesses and customers can make informed decisions about using this payment method.

For businesses, ACH payments provide a way to reduce costs, improve cash flow, and enhance security while offering a convenient and reliable payment option for customers. Meanwhile, customers benefit from lower costs, increased convenience, and greater control over their finances.

As the digital payment landscape continues to evolve, ACH payments remain a trusted and valuable tool for facilitating financial transactions. Whether you’re a business looking to streamline your payment processes or a customer seeking a secure and efficient way to pay bills, ACH payments offer a solution that meets the needs of today’s fast-paced economy.