Recurring ACH Payments

Offering ACH payments, especially for recurring billing, offers a host of compelling benefits for businesses of all types.

Boost Your Business with Recurring ACH Payments

ACH payments are growing in popularity. In fact, consumers processed over 30 billion ACH payments in the United States alone in 2022, totaling a staggering $76.7 trillion.[1] That’s a massive increase from previous years, and experts agree that ACH’s popularity will likely grow in the coming years.[2]

In this article, we’ll review the ins and outs of ACH processing and how to set your business up for success with recurring ACH payments.

What are ACH payments?

Automatic Clearing House (ACH) payments are made via the ACH network that electronically transfers funds from one bank account to another. These payments often take longer than credit or debit card payments, which can be almost instantaneous. However, they allow customers to transfer funds directly from their checking or savings accounts without going through a card network or racking up fees. While ACH payments can take a few business days to complete, they are an extremely secure payment method.

There are two types of ACH payments: debit transactions and ACH credit transactions. Whether a payment is a debit or credit process depends on who initiates the transaction.

If your employer automatically deposits your paycheck in your bank account, you’re already familiar with credit transactions. When the transaction initiator — in this case, your employer — starts a transaction to “push” money from their account into another, it’s a credit transaction.

ACH payments, however, occur when an organization like your business triggers a withdrawal from an account. This “pulls” the money directly from the payer’s account into the merchant’s. For our purposes, we’ll be focusing on ACH debit transactions.

What is a recurring ACH payment?

Recurring ACH payments are just that — ACH transactions that occur at pre-set intervals.

If you run a subscription-based business, you already know recurring payments create unique complications. In the past, accepting payments directly from customers’ bank accounts meant managing an avalanche of paper checks each month or devoting time and resources to manage ACH payments manually.

Now, accepting ACH transactions has never been easier. With modern payment gateways, you can secure your customers’ data and stay in compliance while automating ACH processes.

Payway offers the most advanced management tools available for recurring ACH payments. As a secure payment gateway with fully transparent pricing, we’re here to help you lower costs while increasing your payment options.

See how Payway can help you get started with recurring ACH payments

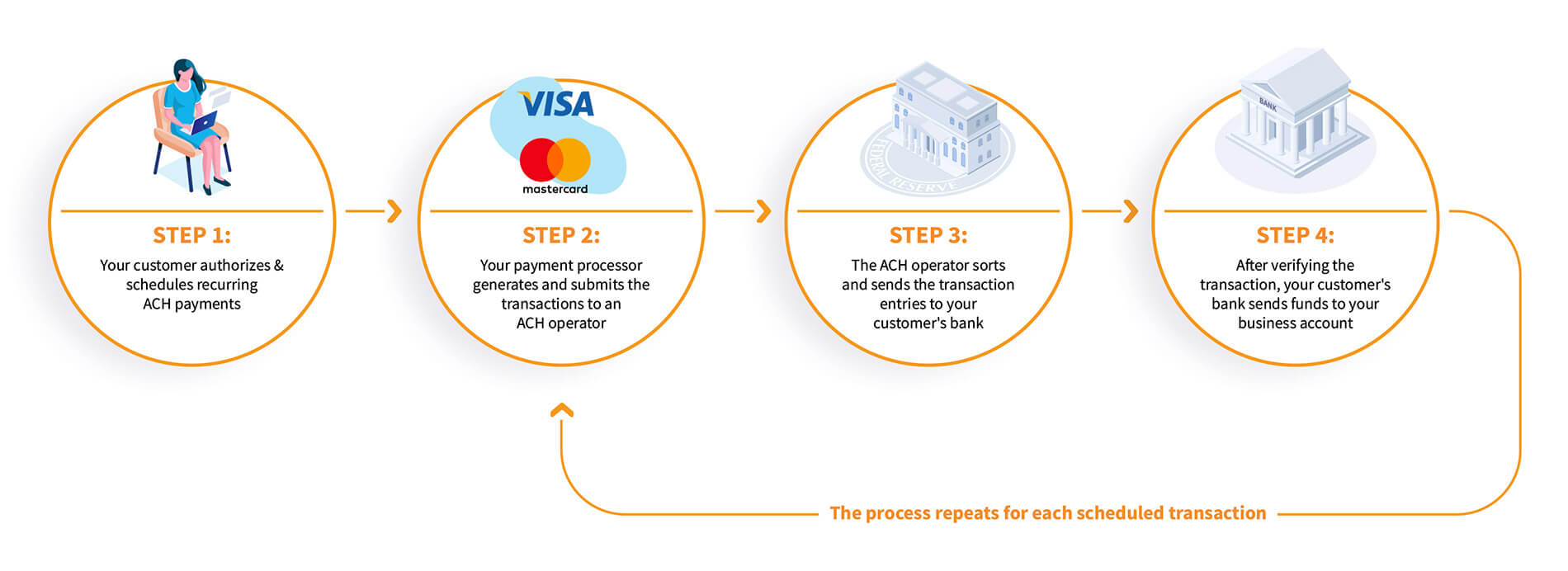

How do recurring ACH transactions work?

We’re so glad you asked! There’s a lot of mystery surrounding ACH payments, so let’s look at the steps subscription-based businesses go through to complete recurring ACH transactions with a payment processor.

Step 1: Payer initiates ACH transaction

Your customers begin the process by setting up regular ACH payments in their accounts. Each month, the payment processor automatically schedules and initiates a new transaction.

Step 2: Payment processor submits the entry

Once the transaction begins, the payment processor collects and submits all current transactions to an ACH operator, like the Federal Reserve Banks, to move money between the customer’s bank and your business account.

Step 3: Operator sorts and sends entries

After collecting all the submitted entries from banks and payment processors, the ACH operator sends them to their destination banks.

Step 4: Bank verifies and sends funds

The bank receives the transaction information and verifies if the customer has enough funds to cover the payment. If they do, your customer’s bank sends the money to your business account.

What are the benefits of recurring ACH payments?

In addition to being a simple and direct payment method, ACH payments have many benefits.

Cost effective

All payment processing comes with a cost. Credit card transactions typically cost businesses 1–4% of the transaction value. ACH payments, however, go through the National Automated Clearing House Association (NACHA), which has significantly lower transaction costs.

Convenience

ACH payments are convenient for you and your customers. Once your customer sets up payments, their subscription fees are automatically debited from their account each month (or on your predetermined schedule).

Improved cash flow management

When your customers choose recurring ACH payments, you get reliable monthly payments, giving you a clearer picture of your revenue.

Increased security

For many, ACH payments replace paper checks. ACH payments are already more secure since no physical document can be lost or stolen. If your ACH payment processor offers tokenization, you and your customers get even more protection since your business will never store customers’ account information.

Fewer failed payments

The chance of failed payments is lower since ACH transactions originate from a bank account instead of a credit card. Your customers’ bank accounts and routing numbers will likely remain the same for years. With ACH, customers don’t generally have to worry about credit limits or expired, canceled, blocked or incorrect account numbers.

Increased customer retention

You can attract and serve more customers when you offer a more comprehensive range of payment options. And with Gen Z’s aversion to debt and credit card use, offering the option to pay directly from their checking or savings account can help you bring in a younger crowd.[3]

ACH drawbacks

Accepting automatic ACH payments seems great, right? Of course, there are some drawbacks. Here are some things to keep in mind as you explore adding ACH to your payment options:

- ACH payments are processed in batches, making them unsuitable for time-sensitive transactions.

- Completing ACH transactions take longer than card payments, so you may not know about declined payments until several days after the transaction is initiated.

- Some payment gateways require more manual work each month to manage ACH payments. Fortunately, since Payway is designed for recurring transactions, we’ve developed a system that eliminates this manual work. However, it is something to consider as you weigh your options.

Who needs recurring ACH payments?

Essentially, any business that accepts recurring payments can benefit from an ACH setup. You may have already seen ACH payments available for the following companies — or set some up for yourself!

- Subscription-based businesses, including popular streaming services like Netflix and Spotify, accept recurring payments. While those may be obvious, other businesses like software as a service (SaaS) companies, gyms and fitness clubs, magazines and subscription boxes can all use ACH transactions to offer frictionless monthly payments.

- Utilities like internet and cell phone services, electric, water, gas, cable and more can allow customers to set up monthly ACH payments to pay bills automatically.

- Insurance companies can allow policy holders to pay their premiums via ACH payments, either automatically or with monthly authorization.

- Property management companies and landlords can ensure prompt monthly payments with recurring ACH payments.

- Nonprofit organizations can benefit from letting donors set up recurring ACH payments when they want to contribute regularly.

How can you set up recurring ACH payments?

If you’re just beginning your online payments journey, we’d love to show you everything Payway has to offer for subscription-based businesses. Reach out to our concierge support team to discuss your options and discover how much you can save and automate with Payway.

Recurring ACH payments are growing in popularity, with benefits including cost-effectiveness, convenience, improved cash flow management, increased security, fewer failed payments, and increased customer retention. Any business that accepts recurring payments can benefit from an ACH setup, and setting up recurring ACH payments is easy with a payment gateway like Payway that’s designed to facilitate and automate them.