What is a Payment Gateway?

Everything You Need to Know

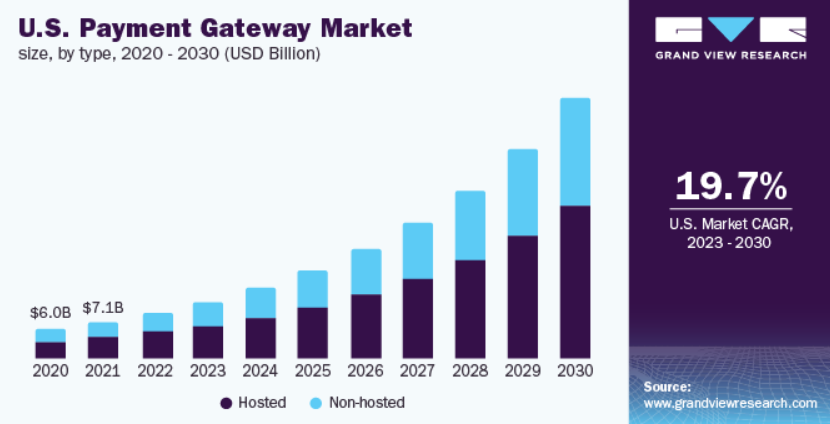

The global payment gateway market was valued at approximately USD 26.79 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 22.2% from 2023 to 2030. This growth is driven by the increasing demand for mobile-based payments and the rising adoption of e-commerce worldwide.*

Businesses are increasingly turning to payment gateways that ensure secure online transactions and protect against credit or debit card fraud. These dependable gateways use encryption to safeguard sensitive information, such as bank account details and card numbers, ensuring secure transfers between customers and issuing banks. Additionally, they simplify the shopping experience by eliminating the need for consumers to visit physical stores or wait in long lines. Instead, customers can complete transactions online with ease, enjoying a smooth and hassle-free shopping process.

A payment gateway is an essential component of modern commerce, especially for businesses seeking to accept online payments securely and efficiently. Whether you’re launching a new e-commerce website or expanding your retail business to include online transactions, understanding what a payment gateway is and how it works is vital for your success.

In this article, we’ll delve into the definition, functionality, importance, and features of payment gateways, and how they differ from other payment processing tools. By the end, you’ll have a comprehensive understanding of this critical technology and how it can empower your business.

What is a Payment Gateway?

A payment gateway is a technology that facilitates the transfer of payment information between a customer’s payment method (such as a credit card or digital wallet) and a merchant’s acquiring bank. Think of it as a virtual equivalent of the card swipe machine you’d find in a physical store. It ensures the secure transmission of sensitive payment data and enables businesses to accept various payment methods online.

Payment gateways work as a secure conduit, complying with strict security standards such as the Payment Card Industry Data Security Standard (PCI DSS). They encrypt sensitive data to protect it during transmission, ensuring customer information remains confidential and secure.

How Does a Payment Gateway Work?

A payment gateway completes a transaction in a matter of seconds, following these key steps:

- Encryption: The payment gateway encrypts (or encodes) sensitive payment information, ensuring it remains private between the buyer and the seller.

- Authorization Request: The gateway sends the encrypted data to the payment processor, which then seeks authorization from the customer’s bank or card issuer.

- Fulfillment: Once authorization is granted, the payment gateway enables the completion of the transaction and notifies the merchant.

This seamless process ensures a secure and efficient payment experience, whether the transaction occurs on a desktop, mobile device, or even via voice-enabled systems.

Why is a Payment Gateway Essential for Businesses?

Here are some of the key reasons why integrating a payment gateway into your business operations is crucial:

- Online Transactions

In today’s digital-first economy, many customers prefer shopping online. A payment gateway enables your e-commerce platform to accept payments seamlessly, opening your business to a vast online market.

- Enhanced Customer Convenience

Customers value convenience. Payment gateways allow your business to offer multiple payment methods, including credit cards, debit cards, and digital wallets, making it easy for customers to complete transactions.

- Robust Security

Security is a top priority for both businesses and customers. Payment gateways utilize advanced encryption technologies and fraud detection tools, reducing the risk of data breaches and unauthorized transactions.

- Building Trust and Credibility

Using a reliable and recognizable payment gateway adds credibility to your business. Customers are more likely to trust and transact with a business that prioritizes secure payment processing.

- Operational Efficiency

By automating the payment process, payment gateways save time and reduce manual effort, allowing you to focus on other aspects of your business.

- Streamlined Record-Keeping

Payment gateways provide detailed transaction records, making it easier to manage sales, monitor customer orders, and simplify financial reporting.

Features to Look for in a Payment Gateway

Not all payment gateways are created equal. When selecting a payment gateway, consider the following features:

- Data Encryption and Security

Ensure the gateway offers robust encryption and complies with PCI DSS standards to protect sensitive customer information.

- Payment Information Storage

Look for a gateway that offers tokenization and secure storage of payment information, allowing customers to make repeat purchases conveniently.

- Virtual Terminal

A virtual terminal enables manual entry of payment details, which is particularly useful for phone or mail orders.

- PCI Compliance Simplification

Gateways that handle transactions on their servers reduce the burden of PCI compliance for your business.

- API Integration

Choose a gateway that provides APIs for seamless integration with your website or app, enabling customization and enhanced functionality.

Payment Gateway vs. Merchant Account

While payment gateways and merchant accounts are both integral to processing online payments, they serve different purposes. A payment gateway handles the secure transmission of payment information, while a merchant account is a type of bank account that allows businesses to accept funds from credit and debit card transactions. Some payment gateways bundle both services, while others require separate setups.

How to Choose the Right Payment Gateway

When selecting a payment gateway, consider the following:

- Compatibility: Ensure the gateway integrates seamlessly with your e-commerce platform or point-of-sale system.

- Pricing: Compare transaction fees, setup costs, and monthly fees to find an option that fits your budget.

- Support: Look for a provider with reliable customer support to assist with any issues.

- Scalability: Choose a gateway that can scale with your business as it grows.

Conclusion

A payment gateway is more than just a tool; it’s the backbone of any business that processes online transactions. By facilitating secure and efficient payments, a payment gateway helps businesses enhance customer trust, streamline operations, and tap into global markets.

When choosing a payment gateway, prioritize features that align with your business needs and ensure you’re set up for success in the digital economy. Whether you’re a small startup or an established enterprise, investing in the right payment gateway is a step toward long-term growth and customer satisfaction.

You’ll want to learn all the players in the payment process and how they work together from the moment a customer’s card has been swiped, keyed into a terminal, or entered into a web page, up to the moment the funds are transferred into your bank account. Our ebook, Understanding the Ins and Outs of Credit Card Processing explains this and more.

*grandwideresearch.com; Payment Gateway Market Size, Share & Trends Analysis Report