During the past few years, payment gateways have stepped out from behind the scenes to play a leading role in how companies provide customers with improved methods for online and digital payments.

A recent shift in business models is also having an impact. Taking a cue from the Software-as-a-Service industry, companies have realized the financial benefits of recurring revenue. This has resulted in more companies offering their products and services through a subscription model. Customers pay a monthly fee and receive a regular delivery of clothing (StitchFix, Trunk Club), pet supplies (Barkbox, Chewy), food (Blue Apron, Harry & David), or personal care items (Dollar Shave Club, Birchbox.)

Here’s 5 things to consider when looking at payment gateways:

- Easy Integration

- Easy Migration

- Security

- Customer Service

- Features

1. Easy Integration

Be sure to ask whether the payment gateway integrates with other critical software your business uses (e-commerce platform, subscription

management) and the time and resources needed to complete the integration. The last thing anyone wants is extra work. That’s why working with a payment solution that’s easy to implement and integrates with other critical software is important.

Look for a payment gateway that offers a payment API integration. API integration allows applications to request and share data between each other seamlessly. With APIs, a developer can consistently get value from data sources and optimize current systems’ capabilities. The payment partner should also provide full support throughout the implementation and integration.

2. Easy Migration

Business owners should regularly evaluate their tech stack to ensure that the right tools are in place to support their business strategy.

Although there’s no set time as to how often you should evaluate your tech stack, there are several things you can look out for, including:

- A change in business needs or goals

- Compliance with a new data and/or security regulation

- Tech is no scalable to support business growth and business processes

- Increasing operational costs

If it’s time to update your payment gateway — which requires moving from one provider to another — your migration should be as easy and seamless as possible for everyone involved. It should include a secure transfer of all account information, such as customer names, addresses, credit card numbers, expirations, and so on. If your systems are up to date, the switch is simpler.

3. Payment Gateway Security

Data security is paramount when it comes to processing payments Without it, businesses — including Target, Adobe, and others — have faced financial loss, a decline in customer trust, and tarnished their brands. More than half of businesses fail to meet standards set by the Payment Card Industry Data Security Standard (PCI DSS), which protects card data and reduces the risk of a data breach. In 2020, 434% of businesses achieved full compliance, compared to 279% in 2019.

Point-to-point encryption (P2PE) is one of the best methods you can use to protect yourself, as well as your customers, and prevent a credit card breach. The simplest way to ensure you’re protected is to partner with a company listed as a Point-to-Point Encryption (P2PE) provider. This way, you can verify the gateway is both certified and PCI-compliant. You also want to protect your company against credit card fraud. At a minimum, the gateway you’re considering should encrypt data at the time of transaction, offer address verification, and be security-code configurable. It should also be able to check and block transactions, and be configurable by transaction source since the characteristics of transaction risks vary by source.

4. Customer Service

When vetting a company, ask if you’ll receive immediate support, personalized service, or if you will be redirected through a series of menus. Things may happen that need immediate attention such as system trouble, suspicious transaction activity, or payment fee questions. The less time you spend trying to get support, the less downtime you’ll incur. Sometimes, identifying the problem and who is responsible can be frustrating. This is when finding a payment provider with exemplary customer service counts even more.

5. Payment Gateway Features

If you run a subscription or recurring revenue business, make sure your payment gateway has features such as Account Updater, Amex Cardrefresher, Customer Payment Recovery and Level 3 processing.

One More Thing…Pricing Models

Payment gateways like Stripe, Braintree and Square offer merchant accounts as part of their services. However, not all gateways require you to sign up with their merchant in order to get the gateway. These providers are system agnostic and can code their gateway to any acquirer or processor. You can bring your own merchant account on board or sign on with one of theirs. There are many advantages to this. You have flexibility to build the solution that will work best for your business.

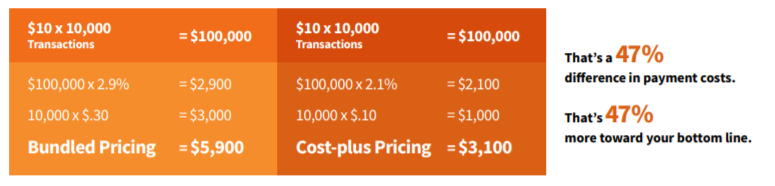

You’ll also benefit from cost-plus pricing. Instead of a blended percentage rate, you pay the published interchange rate, a per-transaction fee and basis points (one basis point is 0.01%). When you run the numbers, cost-plus pricing can save businesses up to 20% in savings over bundled pricing.

Bundled Pricing vs. Cost-plus Pricing

Here’s an example to give you an idea of the difference in pricing methods using an average of $10 per transaction, and 10,000 transactions per month.

*Braintree and Authorize.net published pricing as of November 25, 2019

**2.1% is an average of Card-Not-Present interchange rates published by Visa® and Mastercard®

Final Decision

If your business is struggling to meet revenue goals, it may be due to ineffective payment processing. Knowing what to look for when selecting your payment gateway is one way to overcome this. When you select a payment gateway that’s easy to integrate, easy to migrate to, provides necessary data security, exemplary customer service, recurring payment features as well as cost-plus pricing, you optimize the payment process, leading to profitability, longevity, and success.